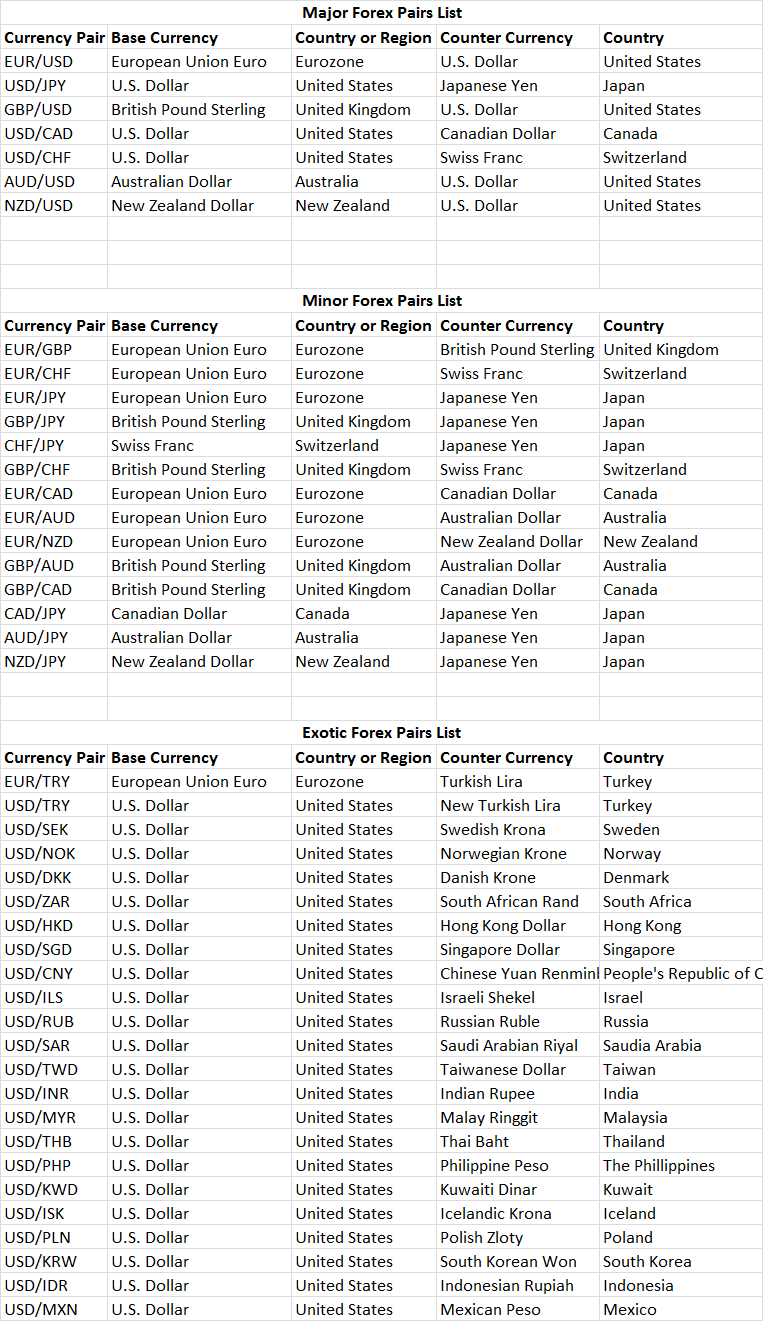

19/5/ · Forex Currency Pairs when trading comes in 3 types – majors, minors and exotics. The major currency pairs are the most actively traded fx pairs as these have the most liquidity. Major forex pairs include EUR/USD, USD/JPY, GBP/USD and USD/CHF 29/1/ · The major pairs are the four most heavily traded currency pairs in the forex (FX) market. The four major pairs at present are the EUR/USD, USD/JPY, GBP/USD, USD/CHF. These The definition of ‘major currency pairs will differ among traders, but most will include the four most popular pairs to trade - EUR/USD, USD/JPY, GBP/USD and USD/CHF. ‘Commodity currencies’ and

Major Currency Pairs: A Guide to the Most Traded Forex Pairs

The major pairs are the four most heavily traded currency pairs in the forex FX market. These four major currency pairs are deliverable currencies and are part of the Group of Ten G10 currency group. While these currencies forex major pairs a significant amount of volume related to economic transactions, they are also some of the most forex major pairs traded pairs for speculative purposes.

The major pairs are considered by many to drive the global forex market and are the most heavily traded. These three pairs can be found in the group known as the " commodity pairs. The five currencies that make up the major pairs—the U. dollar, euro, Japanese yen, British pound, and Swiss franc—are all among the top seven of the most traded currencies as of Volume tends to attract more volume. This is because with more volume spreads between the bid and ask price tend to narrow.

The major pairs have lots of volume, forex major pairs. They, therefore, tend to have smaller spreads than exotic pairs and attract the most traders to them, which keeps the volume high. High volume also means that traders can enter and exit the market with ease, with large position sizes.

In lower volume pairs it may be more difficult to sell or buy a large position without causing the price to move significantly. High volume means more people willing to buy or sell at a given time, too, forex major pairs, resulting in a smaller chance of forex major pairsor smaller slippage when it does occur. That is not to say large slippage can't happen in major pairs.

It can, although much less so than in thinly traded exotic pairs. The currencies of the major pairs are all free-floatingmeaning their prices are determined by supply and demand, forex major pairs.

Central banks may step in to control the price, but typically only when it is necessary to prevent the price from rising or falling so much that it could cause economic harm. Currency prices are constantly changing—especially the majors since there are so many participants putting through orders every second—with the current rate shown via a currency quote. If the rate moves up to 1. If the rate drops to 1. On the right, the price forex major pairs falling as the euro declines in value relative to the US dollar.

Forex Brokers. Your Money. Personal Finance. Your Practice, forex major pairs. Popular Courses. What Are Major Pairs? More than half of trades in the forex market involve the U.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Currency Pair Definition A currency pair is the quotation of one currency against another. Open Position Ratio Definition The open position ratio is a measure of open interest used primarily in forex markets. American Currency Quotation Definition An American currency quotation is how much U. currency is needed to buy one unit of foreign currency.

Pip Definition A pip forex major pairs the smallest price increment fraction tabulated by currency markets to establish the price of a currency pair. What Is Forex FX and How Does It Work? Forex FX is the market for trading international currencies.

The name is a portmanteau of the words foreign and exchange. Partner Links. Related Articles. Forex Brokers 5 Tips For Selecting A Forex Broker. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Pick the Most Profitable Forex Pairs to Trade Daily

, time: 28:18Major Pairs Definition

The definition of ‘major currency pairs will differ among traders, but most will include the four most popular pairs to trade - EUR/USD, USD/JPY, GBP/USD and USD/CHF. ‘Commodity currencies’ and 19/5/ · Forex Currency Pairs when trading comes in 3 types – majors, minors and exotics. The major currency pairs are the most actively traded fx pairs as these have the most liquidity. Major forex pairs include EUR/USD, USD/JPY, GBP/USD and USD/CHF 29/1/ · The major pairs are the four most heavily traded currency pairs in the forex (FX) market. The four major pairs at present are the EUR/USD, USD/JPY, GBP/USD, USD/CHF. These

No comments:

Post a Comment