High Risk Warning: Forex, Futures, and Options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and May 11, · Session High Low EURUSD Day Trading Strategy Setup. There are multiple variations for this strategy. Ultimately, we are looking for price action setups that indicate the price could move to and through the session high or low. Once the session high or low is set, the price must move significantly away from it. This a requirement Jun 28, · Zion_Lion Each day in the forex market, there are at least 2 guarantees for the price of each pair; Guarantee 1- There is going to be a high of the day. Guarantee 2- There is going to be a low of the day. At the beginning of each trading day, an accurate forecast for the high and low could give any trader a very well

Daily High Low Forex Trading Strategy

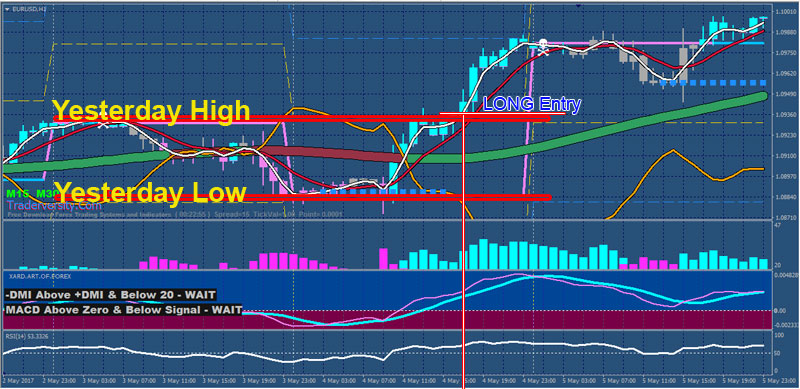

When day trading forex, I use this strategy to capitalize when the price of the EURUSD nears the session London or New York high or low. There are typically stop orders clustered above the session high and below the session low from people who placed trades earlier in the session. That means that when the price approaches the session highs and lows with some momentum, it often blasts through sometimes only temporarily. We need a strategy to capitalize. If you are new to forex, check out the Forex Introduction Course which gives you the information you need to get started in this market.

It is possible to get trades once London closes, and only New York is open, but you want to make sure that the price is still moving a fair bit compared to earlier in the day.

Trade the strategy after 3 AM EST and prior to 3 PM EST. There are multiple variations for this strategy.

Ultimately, we are looking for price action setups that indicate the price could move to and through the session high or low. Once the session high or low is set, the price must move significantly away from it.

This a requirement. Our strategy comes into play once the price moves back, close to, the session high or low after having moved significantly away from it for a while. The session high and low are forex entry high low for each day moving target.

At a given point in time, there is only one session high and session low. Old ones no longer matter for this strategy once they have been penetrated. One of the simplest versions of the strategy is to watch for contracting forex entry high low for each day just below the session high or just above the session low when the price re-approaches.

The price swings just need to be contracting getting smaller with each passing one. Once the price starts contracting, then watch for a consolidation. A consolidation is when the price moves mostly sideways for at least three price bars.

The price must then break out of the consolidation in the direction toward of the session high or session low. I have found slightly better results when the consoldiation forms on the same side of the contraction as the session high or low.

Charts from TradingView. This strategy may provide one or two trades a day, but not always. There are multiple variations of this strategy with slightly different setups.

Look at your charts near the session highs and lows and see if you can spot any other patterns that tend to produce favorable results.

You will see that price usually pops through it. For other trades, check out the Double Pump Day Trading Strategy. The stop loss part of the strategy is simple. Put the stop loss on the other side of the consolidation. If the breakout was to the upside near a session high place the stop loss 0.

If the consolidation breakout was to the downside near a session low place the stop loss 0. You could use a trailing stop loss, or a fixed reward:risk ratio. This latter choice is the simplest and will likely work best for most people. Utilize a reward:risk, meaning if the distance between the entry and stop loss is 4 pips, forex entry high low for each day, then the target is placed 8 pips away from the entry.

If the stop loss is 5 pips, place a target 10 pips away. Often you can get away with a larger than reward:risk, but it may mean holding through some ups and downs in the price.

Or consider the use of a trailing stop loss. Or, if you notice a lot of momentum, or the price is really coiled up and looks like it could explode, possibly look at using a larger target or utilize an aggressive trailing stop loss once the price has surpassed your reward:risk target order not actually placed.

In this case, just use a market order to exit the trade once the trailing stop loss is triggered. This is favorable in situations like the following chart example.

It shows afor a 5. To place quick entries, with a stop loss and target attached, you could use the Market Depth feature in MT4. Then right-click on the EURUSD and select Market Depth. Or on your EURUSD chart, right-click and select Market Depth. As the price is consolidating you will know how big your stop loss is. Put it in the SL box. If your stop loss is going to be 4 pips, put 40 in the box because it is based on fractional pips.

If your target is going to be 8 pips, put 80 in the TP box. Enter your position size in the middle box based on your account size, stop loss level, risk tolerance. To calculate position size quickly, you can use this online position size calculator. Be sure to test this all out in a demo account before using as some brokers may be different, forex entry high low for each day. When the price breaks above the consolidation, click Buy near session high. When the price breaks below the consolidation, click Sell near session low.

This should instantly get you into a trade with your stop loss and target also placed. If a confirmation screen pops up, that could slow you down. Want to learn more about how to crush the EURUSD in 2 hours or less a day? Then check out the EURUSD Day Trading Course. As mentioned, there are multiple ways to enter trades when the price approaches the high or low. At about EST the price approached the daily low blue horizontal line set earlier in the London session. The price drifted higher.

The price then fell close to the low and formed a consolidation. We know that lots of people likely have stop orders entry and exit forex entry high low for each day that daily low level, so it is likely to get touched and shoot past, even if only briefly. A consolidation just above the daily low provided an entry opportunity.

Just a consolidation that provided an entry near the key level. This same pattern played out a couple other times earlier in the session as well also marked. Forex entry high low for each day we can be on the look for contractions, OR, sometimes just consolidations provide us our entry.

The stop loss goes on the opposite side of the consolidation, and a profit target is placed at a reward:risk. The chart below may look a little squished. That is because when I trade I typically use the same y-axis amount each day. This way, I can assess price wave size day to day on the same scale.

If you zoom in, even a 5 pip move looks huge. I typically set my y-axis to a little more than the daily average movement. Around this time it was 80 pips per day, so my y-axis is manually set to 80 pips…. just in case you forex entry high low for each day wondering.

The y-axis amount changes over time. On most of my example charts I zoom in to make the patterns clearer. Disclaimer: Nothing in this article is personal investment advice, or advice to buy or sell anything. Trading is risky and can result in substantial losses, forex entry high low for each day, even more than deposited if using leverage. Cory is a professional trader since In between trading stocks and forex he consults for a number of prominent financial websites and enjoys an active lifestyle.

He runs TradeThatSwing and coaches individual clients, forex entry high low for each day. Hi Chris. I have traded both sessions in the past, but typically focused on only one at a time. So if you like staying up late, trade London. Either is fine. Splitting the two with a bit of sleep and trying to trade both in the same day will likely wear you out…I tried it and my trading and quality of life suffered.

Stick to one session. I usually only trade for about a 2 hour period during the overlap period of London and New York. It provides ample opportunity most days some days I end up taking no trades because there are no setups or conditions are too quiet. After London closes the opportunities tend to dwindle. Great strategy thanks for sharing. I had a quick question on how much to trade, hope this is a good place to drop it. Since the London session has much larger volume and swings do you or have you traded that session as part of your regular trading routine?

Have you tried a split sleep routine to catch both sessions? Thanks, Chris. Save my name, email, and website in this browser for the next time I comment. Notify me of follow-up comments by email. Notify me of new posts by email. Sign Up for My Free Weekly Trading Tips Newsletter.

3 Trading Entries That Will Change The Game - (Simple \u0026 Powerful)

, time: 16:21Forex Daily High Low prices List (Helpful Tool for traders)

May 11, · Session High Low EURUSD Day Trading Strategy Setup. There are multiple variations for this strategy. Ultimately, we are looking for price action setups that indicate the price could move to and through the session high or low. Once the session high or low is set, the price must move significantly away from it. This a requirement Jun 28, · Zion_Lion Each day in the forex market, there are at least 2 guarantees for the price of each pair; Guarantee 1- There is going to be a high of the day. Guarantee 2- There is going to be a low of the day. At the beginning of each trading day, an accurate forecast for the high and low could give any trader a very well How to Day Trade the Forex Market – Trade Examples. Here is the April 14 EURUSD 1-minute chart, along with comments below. I traded for about an hour and a half. How to day trade the forex market – EURUSD 1 minute (click to enlarge) This day (two hour period) was dominated by news at Estimated Reading Time: 7 mins

No comments:

Post a Comment